Community Empowerment - Dr. SBM Prasanna, Dr. K Puttaraju, Dr.MS Mahadevaswamy (best inspirational books txt) 📗

Book online «Community Empowerment - Dr. SBM Prasanna, Dr. K Puttaraju, Dr.MS Mahadevaswamy (best inspirational books txt) 📗». Author Dr. SBM Prasanna, Dr. K Puttaraju, Dr.MS Mahadevaswamy

References

Crawford, S. Cromwell (1982), The evolution of Hindu ethical ideals, Asian Studies Program, University of Hawaii Press

Desai & others -India Human Development in India -challenges for a society in transition 2010

Kishore Choudhary. (2011), Effect of Globalization on Rural Entrepreneurship in India, Half Yearly Global Economic Research Journal, Vol. I, Issue, pp. 88-92

Mohapatra & Mohapatra, Hinduism: Analytical Study 2012

Phillip Wagoner-Dharma: Hindu Approach to a Purposeful Life 2012

Puruashotthama billimoria -Indian Ethics – Traditions & Contemporary Challenges

Report On The Education For Values In Schools - A frame work – Department of Educational Psychology New Delhi 2011

Rokeach, M. (1973). The Nature of Human Values. New York: judge coronel The Free Press.

Tiwari, K. N. (1998), Classical Indian Ethical Thought: A Philosophical Study of Hindu, Jaina, and Buddhist Morals, Motilal Banarsidass Publishers

Wilhelm Halbfass, Tradition and Reflection - Explorations in Indian Thought, State University of New York Press

William F. Goodwin, Ethics and Value in Indian Philosophy, Philosophy East and West, Vol. 4, No. 4 (Jan., 1955),

Progress of Micro Finance-SHGs in Women Empowerment in the State of Karnataka

Mr.Srinivas.K.T* & Mr. Devaraju**

*Research Scholar, DoS in Commerce, University of Mysore, Mysore.

**Research Scholar, DoS in Commerce, University of Mysore, Mysore.

Abstract

Microfinance refers to small savings, credit and insurance services extended to socially and economically disadvantaged segments of society. It is emerging as a powerful tool for poverty alleviation in India. India falls under low income class according to World Bank. It is second populated country in the world and around 70 % of its population lives in rural area. 60% of people depend on agriculture, as a result there is chronic underemployment and per capita income is only $ 3262. This is not enough to provide food to more than one individual. The obvious result is miserable poverty, low rate of education, low sex ratio, and exploitation. The major factor account for high incidence of rural poverty is the low asset base. According to Reserve Bank of India, about 51 % of people house possess only 10% of the total asset of India .This has resulted low production capacity both in agriculture (which contribute around 22-25% of GDP) and Manufacturing sector. Rural people have very low access to institutionalized credit (from commercial bank). This paper puts forward to know the progress of Micro-finance-SHGs in Women empowerment in the state of Karnataka, to achieve the above said objective data gathered from primary and secondary Source, from the present study effects of Micro-finance-SHGs are identified; Women gets self employment, which leads in rise in income level, intern which helps for better standard of living, then women empowerment, later self reliance, then slowly poverty can be alleviation. from the a present study it is found that Bidar district stood at first place in terms of having more number of women SHGs i.e. 22,05 in the state of Karnataka. S.Canara stood at second place with women SHGs of 20,966. Then Mandya stood at third place with 16,503 SHGs. with this fact it can be conclude that these districts are contributing good efforts for women empowerment through SHGs.

Keywords: Microfinance, SHGs, Women Empowerment, Poverty Alleviation,

Introduction

Microfinance is emerging as a powerful instrument for poverty alleviation in the new economy. In India, Microfinance scene is dominated by Self Help Group (SHGs)-Bank Linkage Programme as a cost effective mechanism for providing financial services to the “Unreached Poor” which has been successful not only in meeting financial needs of the rural poor women but also strengthen collective self help capacities of the poor ,leading to their empowerment. Rapid progress in SHG formation has now turned into an empowerment movement among women across the country. Economic empowerment results in women’s ability to influence or make decision, increased self confidence, better status and role in household etc. Micro finance is necessary to overcome exploitation, create confidence for economic self reliance of the rural poor, particularly among rural women who are mostly invisible in the social structure.

In the development paradigm, Micro-finance has evolved as a need-based policy and program to cater to the so far neglected target groups (women, poor, rural, deprived, etc.). Its evolution is based on the concern of all developing countries for empowerment of the poor and the alleviation of poverty. Development organizations and policy makers have included access to credit for poor people as a major aspect of many poverty alleviation programs. Micro-finance programs have, in the recent past, become one of the more promising ways to use scarce development funds to achieve the objectives of poverty alleviation. Furthermore, certain Micro-finance programs have gained prominence in the development field and beyond. The basic idea of Micro-finance is simple: if poor people are provided access to financial services, including credit, they may very well be able to start or expand a micro-enterprise that will allow them to break out of poverty.

According to Vice President of World Bank Micro finance can be the biggest instrument in the fight against poverty. Despite the South Asian Region’s pioneering experiments in micro finance-successful instances include the Grameena Bank in Bangladesh and Self Help Group – commercial bank linkage in Rural India – More than 3/4th of the poor families in the region still do not have reliable and organized financial services. This means that they and their little business cannot link up to the modern banking facilities.

Micro financing has attained a special role as an instrument in poverty reduction the world over. There is a realization at both the government and donor agency levels that Micro-finance programs in India also enable empowerment of women. However, there have been doubts about this role of improvement in livelihoods and access to resources and social benefits such as improvement in knowledge and participation of selected Micro-finance programmes. Thus, Micro-finance has become one of the most effective interventions for economic empowerment of the poor.

Empowerment implies expansion of assets and capabilities of people to influence control and hold accountable institution that affects their lives (World Bank Resource Book).Empowerment is the process of enabling or authorizing an individual to think, behave, take action and control work in an autonomous way. It is the state of feelings of self-empowered to take control of one’s own destiny. It includes both controls over resources (Physical, Human, Intellectual and Financial) and over ideology (Belief, values and attitudes) (Batliwala, 1994). Empowerment can be viewed as a means of creating a social environment in which one can take decisions and make choice either individually or collectively for social transformation. It strength innate ability by way of acquiring knowledge power and experience.

Empowerment is a multi-dimensional social process that helps people gain control over their own lives communities and in their society, by acting on issues that they define as important. Empowerment occurs within sociological psychological economic spheres and at various levels, such as individual, group and community and challenges our assumptions about status quo, asymmetrical power relationship and social dynamics. Empowering women puts the spotlight on education and employment which are an essential element to sustainable development.

Concept and Features of Micro Finance

The term micro finance is of recent origin and is commonly used in addressing issues related to poverty alleviation, financial support to micro entrepreneurs, gender development etc. There is, however, no statutory definition of micro finance. The taskforce on supportitative policy and Regulatory Framework for Microfinance has defined microfinance as “Provision of thrift, credit and other financial services and products of very small amounts to the poor in rural, semi-urban or urban areas for enabling them to raise their income levels and improve living standards”. The term “Micro” literally means “small”. But the task force has not defined any amount. However as per Micro Credit Special Cell of the Reserve Bank Of India , the borrowal amounts upto the limit of Rs.25000/- could be considered as micro credit products and this amount could be gradually increased up to Rs.40000/- over a period of time which roughly equals to $500 – a standard for South Asia as per international perceptions.

The term micro finance sometimes is used interchangeably with the term micro credit. However while micro credit refers to purveyance of loans in small quantities, the term microfinance has a broader meaning covering in its ambit other financial services like saving, insurance etc. as well.

The mantra “Microfinance” is banking through groups. The essential features of the approach are to provide financial services through the groups of individuals, formed either in joint liability or co-obligation mode. The other dimensions of the microfinance approach are:

Savings/Thrift precedes credit

Credit is linked with savings/thrift

Absence of subsidies

-Group plays an important role in credit appraisal, monitoring and recovery.

Basically groups can be of two types:

Self Help Groups (SHGs): The group in this case does financial intermediation on behalf of the formal institution. This is the predominant model followed in India.

Grameen Groups: In this model, financial assistance is provided to the individual in a group by the formal institution on the strength of group’s assurance. In other words, individual loans are provided on the strength of joint liability/co obligation. This microfinance model was initiated by Bangladesh Grameen Bank and is being used by some of the Micro Finance Institutions (MFIs) in our country.

Statement of the Problem

Mitigation of poverty, the core of all developmental efforts has remained a very multifaceted and serious concern for developing countries. Experience has shown that many of the poverty alleviation programmes have not achieved the expected success. In spite of considerable improvement in the status of women, they still comprise the largest section of deprived population. Empowerment of women is seen as one of the most important means of poverty eradication. Lack of capital is a serious constraint to the development of poor women in rural and urban areas who find little or no access to credit. Credit can help women take-up farm and allied activities such as keeping milch cattle, poultry or independent small enterprises, enabling them to respond to the opportunities created by the process of development.

Micro credit for women has been the mantra that has worked like nothing else in pulling the poor women out of poverty and empowering them wherever it was introduced. In the field of Micro-finance, Financial Inclusion and Self Help Groups’ Bank Linkage Programme, with the active support of Government of India and NABARD for wiping out absolute poverty from the country. In this back ground present study is chosen to know the progress of Micro finance -SHGs in the state of Karnataka for alleviation of poverty and empowering women through micro-finance.

Objectives of the Study

To understand the concept of micro finance and its importance.

To study the Progress of SHGs formation in the state of Karnataka

To study the number of Women SHGs in the state of Karnataka

to know the SHGs Savings with Bank in the state of Karnataka

To offer suitable suggestions based on the findings of the study.

Scope of the Study

The present study is confined to the Micro finance - SHGs in the state of Karnataka only.

Data Collection:

To achieve the aforesaid objectives data gathered from primary as well as secondary sources. Primary data collected by interacting the with officials of department of Department of Micro Finance, Karnataka State Co operative Apex Bank Ltd., Chamarajpet, Bangalore. Secondary data collected from various published reports Apex Bank Ltd, research articles, and from official circulars.

Tools used for analysis

The collected data analyzed by using simple statistical tools like ratio, tables, graphs etc.

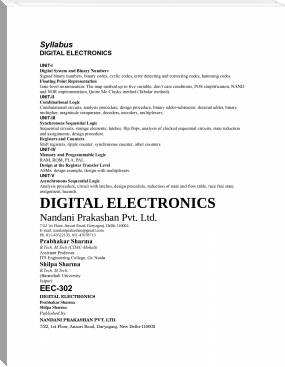

Table No.1 : Table showing the Progress of SHGs Formation for the Month End December 2014

Sl. No.

Name of The DCCB

Progress as on

Comments (0)